Copyright © 2011-2014 airxc.com, airxcell.com

Table of Contents

AirXCell provides various "forms" aimed at simplifying the loading, manipulation and visualization of Asset and FOREX quote timeseries. The 1. Manage Asset form provides the user with a mean to load timeseries, manipulate them, visualize them, etc.

The very first step in a lot of AirXCell advanced financial features consists in loading asset or FOREX quotes timesries within the AirXCell environment. This How-To chapter provided the user with a walkthroug in the different steps involved in doing so.

While loading asset or FOREX quotes can easily be performed manually by the user in the

R console or using an

R Code Editor with the help of the quantmod

package for instance, the

1. Manage Asset form

provides a way to do it only in a few clicks.

One should not that Asset and FOREX quotes loaded with the help of both the

1. Manage Asset

or

2. Manage FOREX

forms are not of class xts (timeSeries) but rather of class AXCAsset and

respectively AXCForex. These two classes are wrapper around xts timeSeries

that come with a few handy methods.

After the usual login procedure, the user is presented the quick start box which he can use to create a new workspace.

The first step is then to use the top menu bar to open a new

1. Manage Asset form.

A new "1. Manage Assets" form can be added to the workspace by using

Form → 1. manage assets

(![]() )

)

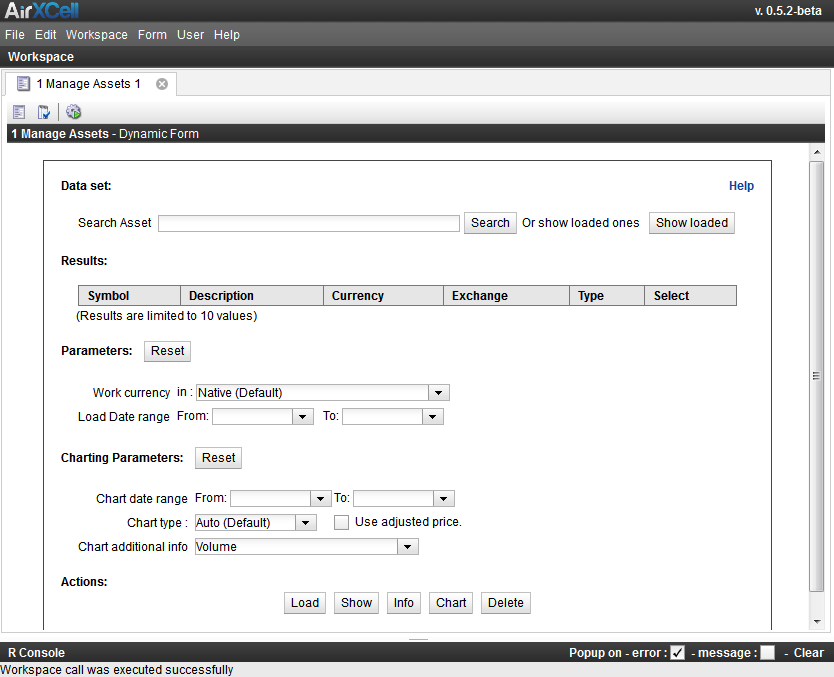

Figure 3.1, “Empty 1. Manage Assets form” shows a 1. Manage Assets dynamic form right after it is added to the user workspace:

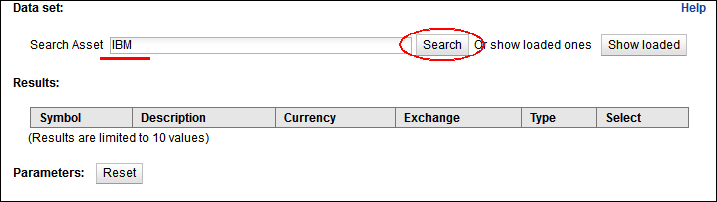

Then we need to search for the asset we want to display. In this example, we'll use 'IBM' as the test asset. As a sidenote, an alternative to searching an asset is to use the "Show loaded one" button to use an asset that has already been loaded into the workspace.

One simply needs to type 'IBM' in the search field and press the 'Search' button as shown on Figure 3.2, “Search IBM”:

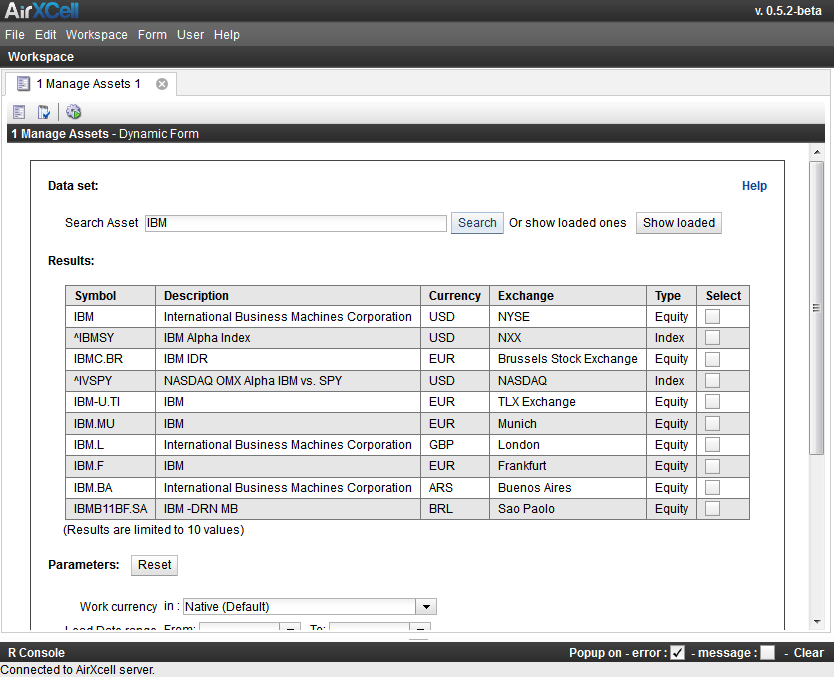

The system then displays the result found for the query 'IBM'. The asset we are interested in is shown on the first position : Figure 3.3, “Results for IBM”:

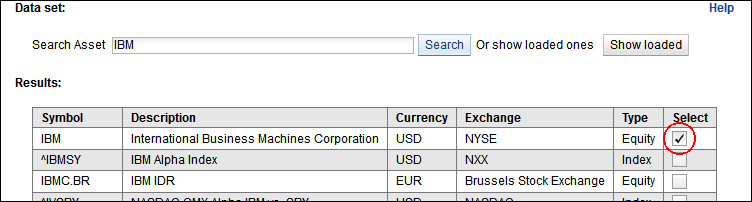

The 1. Manage Asset form works with the following pattern

- The user selects one or several assets using the Check Boxes shown on the list of results

- The user performs an action on all selected assets using the buttons on the bottom of the form.

In our case, we select the asset we are interested in as shown in Figure 3.4, “Selecting IBM”:

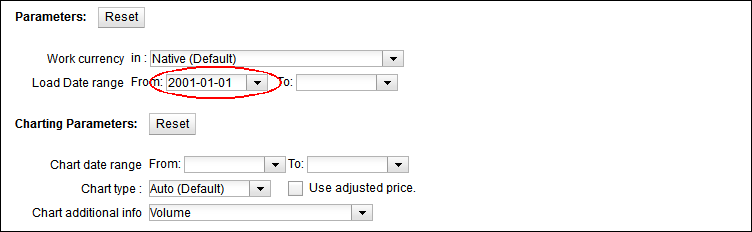

Then, we choose the start date from which the IBM quote timeseries would be loaded. The default, whenever the date is left blank, is to load 5 years of data. Let's assume we want some more and use "2001-01-01" as the start date as shown on Figure 3.5, “Set start date”:

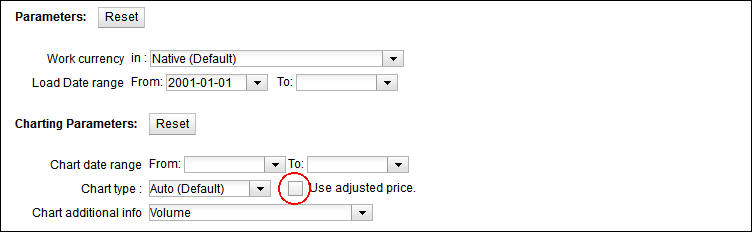

Initially, we want to chart the whole timeseries, running from "2001-01-01" to today. In this case, it makes no sense to use the default "candlestick" chart. In addition, since there migth well have been splits or merges during such a long period, we're better of using the "Adjusted" price that provides a coherent price accross the full period.

The usage of the "Adjusted price" is selected by ckecking the box shown on Figure 3.6, “Select adjusted price”:

We are left with loading the Asset Quotes using the Load button as shown Figure 3.7, “Load IBM”:

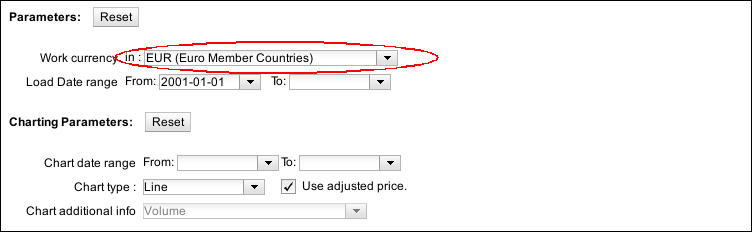

AirXCell provides the user with means to load asset quotes in different currencies that the trade currency. Whenever the user chooses to do so, the required FOREX quotes are automatically loaded and applied transparently to the asset quotes.

First, we need to set the "Work currency" to 'EUR' as shown on Figure 3.8, “Load IBM in native currency (USD)”:

We can now press the 'Load' button again to load the 'IBM' asset quote timeseries in 'EUR'.

Loading a FOREX is performed just the same way, using a 2. Manage FOREX form instead of the 1. Manage Asset form.